“Guided by our mission of Building a Modern Energy System and Co-building a Better Ecology, ENN Energy is committed to leading the way in stimulating innovation and transformation, leading green and low-carbon practices, advancing industry intelligence, and setting the benchmark for secure & quality services.”

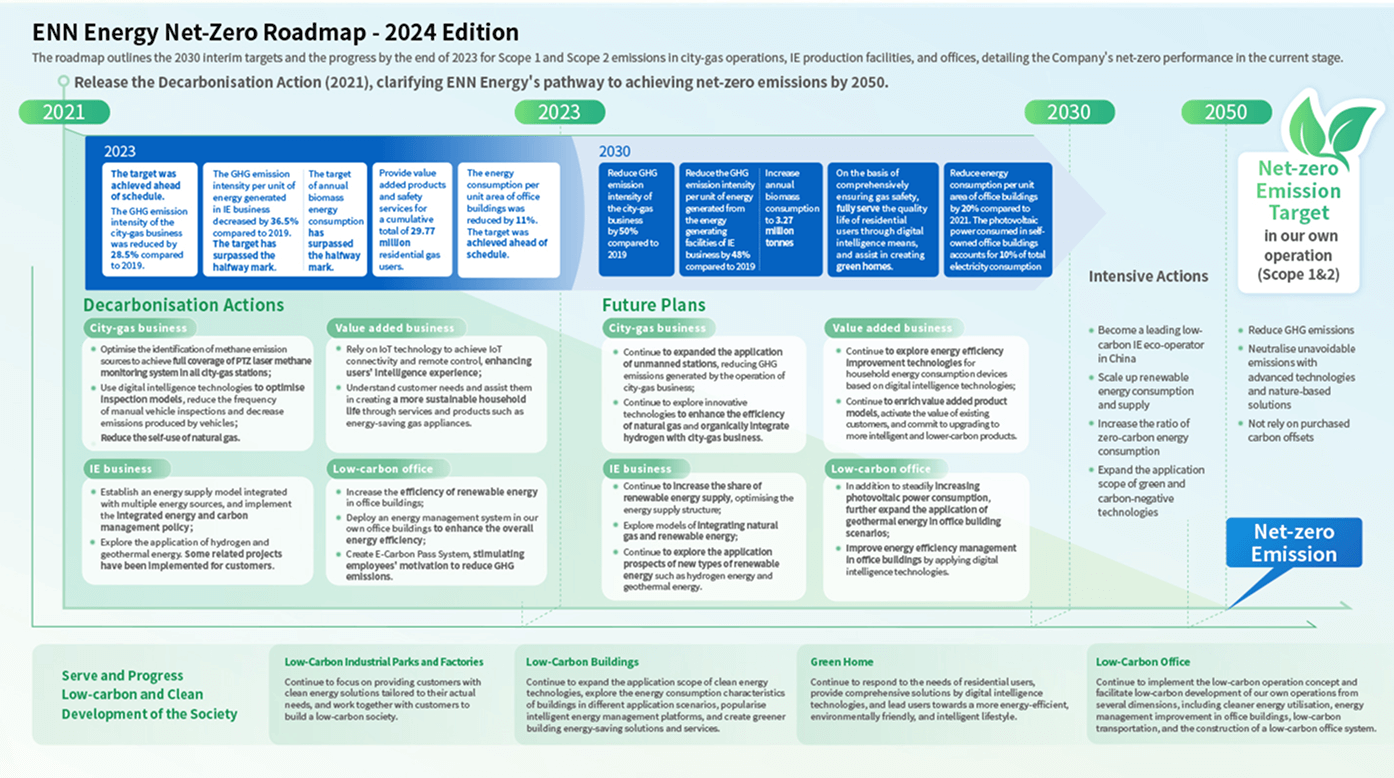

Based on its business operations, ENN Energy references leading domestic and international low-carbon transition standards and frameworks to set environmental and corporate low-carbon transition targets, while outlining a clear net-zero roadmap that provides guidance for its energy conservation and emission reduction efforts.

Since some targets have been achieved ahead of schedule in Decarbonisation Action 2021, the Company has set more ambitious new targets, demonstrating its determination to advance on the path to low-carbon transition. Meanwhile, the Company will optimise the emission reduction measures in various business scenarios to ensure the achievement of its long-term goals.

Through the release of the Decarbonisation Action 2024, ENN Energy reaffirms its mission to “achieve the coordinated development of its own carbon reduction and the green upgrading of business, contributing to high-quality social development”. Moving forward, the Company will further integrate sustainability into its business practices and deeply explore market demands for green energy consumption driven by customer needs. By leveraging technology, it will continuously innovate products and services to promote intelligent upgrades in the industry. The Company will work hand in hand with upstream and downstream partners to support the realisation of China’s “Dual Carbon” goals.

In December 2023, ENN Energy released its first climate-related financial disclosure report. This report aims to demonstrate the Company's attention to climate change issues and its determination to actively address climate-related risks and seize climate-related opportunities, in response to the requirements and expectations of regulators, the capital markets, and stakeholders for climate-related financial disclosure.

In this released climate-related financial disclosure report, ENN Energy provided a detailed overview of the impact of its Governance, Strategy, Risk Management, and Metrics and Targets on the Company's operations and business model by referring to the Task Force on Climate-Related Financial Disclosures (TCFD) framework.

The Board of Directors of ENN Energy continues to improve its climate change governance structure in response to the global climate challenge. ENN Energy is committed to effectively promoting the implementation of climate strategy, reducing the impact of climate-related risks on the Company's development and operations through organisational safeguards, and seizing development opportunities from energy globalisation and low-carbon transition.

ENN Energy has committed to a green and low-carbon transition as part of its significant strategy plan. The Company has developed a comprehensive strategy to implement six major emission reduction actions in the areas of (1) city gas methane management, (2) low-carbon trade and transportation, (3) energy structure transformation of the integrated energy business, (4) system energy efficiency improvement, (5) green technology application, and (6) green office. ENN Energy also establishes short and medium-term carbon reduction targets for 2030 and the long-term carbon neutrality target for 2050. The Company conducts a review and adjustment of these targets every three years to ensure their science, rational, and effectiveness.

ENN Energy considers effective risk and compliance management to be critical to the Company's development and has continued to improve its enterprise risk management system.

ENN Energy has identified nine types of risks: policy and price; compliance; operation; reputation; legal; health, safety and environment (HSE); market; finance; and climate change. Among these, climate-related risks, which might have significant impacts on the Company's business scope, has been integrated into the overall risk management process of ENN Energy.

In 2023, ENN Energy identified a total of 40 climate-related risks and opportunities, including 10 physical risks, 14 transition risks, and 16 opportunities. Based on this identification, each risk was deeply considered and scored in terms of likelihood and severity through expert assessment and workshops with ENN Energy. A shortlist of most crucial climate-related risks and opportunities was then developed based on their possibility and materiality to the Company, of which comprising five risks and two opportunities. An in-depth financial quantitative assessment (Value-at-Stake analysis, VaS) was conducted for the shortlisted risks and opportunities.

For the identified key climate risks and opportunities, ENN Energy has set up corresponding tracking metrics and targets for physical risks, transition risks, climate opportunities, and capital deployment, to monitor and manage climate-related risks in order to minimize negative impacts on business operations in a timely manner, while actively seizing market opportunities arising from the low-carbon transition. This was done in accordance with recommendations from the TCFD and with reference to the Hong Kong Exchange and Clearing Limited’s (HKEX) Enhancement of Climate-related Disclosures Under the Environmental, Social and Governance Framework xi and the International Sustainability Standards Board’s (ISSB) International Financial Reporting Sustainability Disclosure Standard 2–Climate-Related Disclosures.

ENN Energy attaches great importance to cultivating employees' environmental awareness. We regularly conduct training and publicity covering all employees of enterprises in various regions through the "Digital Intelligence Government-Enterprise Platform". Annually, we carry out environmental protection training for employees on themes such as energy efficiency improvement, waste reduction and resource utilization, and water resource management. We also strengthen employees' awareness of climate change to mitigate the negative impacts brought by industrial transformation or climate change.

The ENN Energy Holdings Limited ("ENN Energy") has established a Green Finance Framework ("Framework") that sets out how it proposes to use the amount equal to net proceeds to finance or refinance on green projects that in line with the company development strategy, so as to support the company to achieve long-term sustainable development.

ENN Energy Green Finance Framework aligns with the 2021 Green Bond Principles ("GBP 2021") of the International Capital Market Association, and the 2023 Green Loan Principles ("GLP 2023") developed by the EMEA Loan Market Association, Asia Pacific Loan Market Association and Loan Syndications & Trading Association.

S&P Global Ratings released the Second Party Opinion (SPO) report on 30 September 2024, stating that the four components of ENN Energy’s Green Finance Framework, including the use of proceeds, process for project evaluation and selection, management of proceeds and reporting, are aligned with the Green Bond Principles (GBP) and Green Loan Principles (GLP).

The SPO report also assigned a “Dark Green” rating to ENN Energy’s Green Finance Framework, the highest level on S&P Global Ratings’ “Shades of Green” spectrum. This is a strong endorsement of the Framework’s contribution to long-term climate resilience and low-carbon transition.

ENN Energy is responding to the national biodiversity conservation strategy and adhering to the sustainable development. It has clarified the medium- and long-term decarbonisation action goals, and integrated biodiversity conservation concepts and measures into corporate strategies and daily operations.

On May 22, 2022, the 29th International Day for Biodiversity Conservation, ENN Energy released its first Biodiversity Conservation Report , which systematically discloses the Company's practices and achievements in terms of biodiversity conservation. The report disclosed measures taken by the Company for protecting the ecology through five dimensions, land use change, climate change, pollution, overexploitation and species invasion.